“There is nothing else besides Web3.0 that can be done here in Hong Kong.”

Arwin has two favourite things in his life: Shisha and Web3.0

Sitting at the balcony of MoonKok, a bar in Central, Arwin smokes a pot of ‘sandalwood’ and ‘morocco’ flavor shisha after a busy day of visiting the Web3.0 Festival in Hong Kong.

Being the co-founder of BALM Ventures, a Web3.0 start-up company in the US, Arwin Hu flies back and forth between Hong Kong and San Francisco frequently. He hopes to see more of the Web3.0 industry in Hong Kong because…

“Hong Kong has an aging population as many young people have moved abroad. In the meantime, many financial institutions transferred to Singapore, and the re-exportation business has been declining as Hainan gradually became the re-exportation center for mainland China,” he said. “There is nothing else besides Web3.0 that can be done here in Hong Kong.”

Coinunited.io advertisement in Tsim Sha Tsui, Hong Kong.

Arwin’s views about Hong Kong’s current problems may sound aggressive, but the potential in Web3.0 development is bound to grow.

“For decentralized finance in Web3.0, I’m sure the highly developed centralized finance here could be its steady backup. For example, being the world’s second largest art auction market, NFT could easily find its place in Hong Kong.”

So, how’s Hong Kong doing?

Where it all started...

The year 2008 was when the global financial crisis hit hard. In January of that year, Time Magazine put ‘NyLonKong’ on their cover. This term is a contraction of New York, London, and Hong Kong. These three cities were the first to react and were the last ones standing.

Challenge. Opportunity. Change. NyLonKong were intertwined at the time, and they were ready to tackle the obstacles ahead.

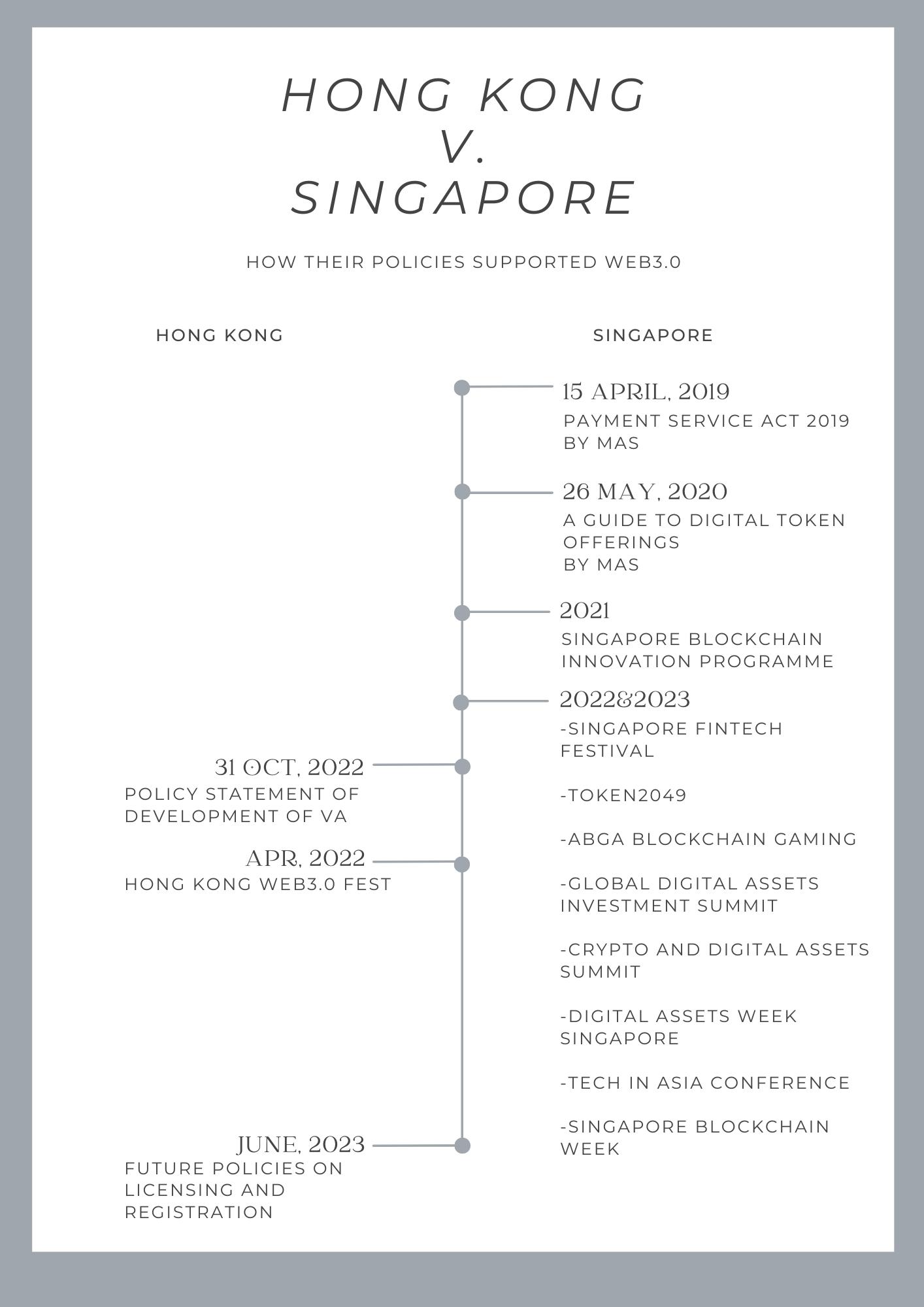

But when it comes to decentralized finance in Web3.0, Hong Kong seems to be too hesitant to make a move. Instead, Singapore has been chasing the position of being Asia’s main financial center after Hong Kong with the help of decentralized finance.

Central, Hong Kong at night.

How is Hong Kong doing with DeFi?

“Hong Kong does not rely on policies to develop industries, but on its people”

Being one of the ‘Crypto Haven’ countries, Singapore has pushed out regulations as early as 2017 following the boom of initial coin offerings in 2016. The regulations on cryptocurrency could effectively benefit virtual asset providers and investors by limiting the frauds in cryptocurrency. For example, the Luna Coin crash wiped out nearly US$60 billion in the cryptocurrency space.

The regulations also put requirements on large entities by segregating the different functions of their business. So that failure like FTX, a large company that formerly operated cryptocurrency exchange and crypto hedge fund, would be avoidable. These regulations could also apply to financial institutions to balance and stabilize centralised finance and decentralised finance.

However, Hong Kong didn’t push out any regulations until 2022. Ultimately, does this mean Hong Kong is operating its crypto market without proper regulation?”

“Although there was no specific legislative act in Hong Kong to regulate virtual assets, I don’t think it would be appropriate to say Hong Kong was lawless on cryptocurrency since Hong Kong retains its common law system. This means misrepresentation, fraud or criminal offenses in all fields, including in the field of cryptocurrency,” said Yunan Ren, CEO of OKG Technology, in a zoom interview.

“It is important to note what attitude the Hong Kong government holds, but I don’t think we need policies of any kind because Hong Kong does not rely on policies to develop industries.”

On October 31st, 2022, the Hong Kong government released the “Policy Statement on Development of Virtual Assets in Hong Kong” to embrace the coming of Web3.0 and the Metaverse, as well as support NFT and stablecoins.

The promulgation of the policy has provoked lively discussions, and its positive attitude towards Web3.0 development has attracted the participation of enterprises, investors, initiators, and sponsors in Hong Kong.

HKD.com, a digital asset trading platform in Hong Kong, had its first physical store in 2021.

“Singapore pushed a new rule which comprehensively regulates the payment and investment sectors of virtual assets, while Hong Kong didn’t come up with any legislative frameworks on these two sectors yet,” Tam Wing See, lawyer at Eversheds Sutherland said in a zoom interview. “It’s actually not a bad thing because it gives room to corporations to fully explore the new market. They can have the test kit to try.”

As for now, Hong Kong’s Securities and Futures Commission proposed certain rules and regulations for virtual assets trading platforms, including license registration for businesses. Platforms will then have to review and revise their systems before going into the new regulated market.

Hong Kong is pacing up.

There are a number of cryptocurrency ATMs now in Hong Kong.

Hong Kong is catching up and growing

“I remained confident and have continued to work in the crypto industry ever since.”

April Wong had a decade of experience in international advertising agencies. She was a director at McCann Erickson, Publicis, and Ogilvy, where she focused on several global brand campaigns and product launches for top corporations. However, she waved goodbye to the Madison Avenue agencies and decided to enter the crypto industry in May 2019.

By the time April joined Crypto.com in 2019, she had a limited knowledge of CeFi and DeFi, but a strong belief that decentralisation was the future.

“I initially entered the crypto industry with a belief that all crypto was decentralized,” said April. “However, after Crypto.com launched their DeFi products, I saw their potential for novel innovations in crypto and wanted to explore the concept of true decentralization. From there, I ended up joining Bancor.”

April led Bancor’s product and commercial launches with comprehensive crypto marketing strategies which differs in certain ways from her experience in previous roles. She mentioned that community voting is a significant factor in decision-making in DeFi, as opposed to a singular management team. And how DeFi focuses more on decentralization innovations, while on CeFi, the emphasis is more on overall user interface.

After three years of career growth and development, April joined HashKey Group in January of this year. It is one of the digital asset leaders in Asia, where she successfully organized Asia’s biggest Web3.0 event- The Web3.0 Fest Hong Kong. Looking back at April’s transition from an advertising expert to a crypto marketer, it is not an easy journey, but she’s not the only one who was brave enough to give it a try.

“I believe that there is a large influx of professionals, including marketing, legal, and banking professionals, entering the DeFi industry,” said April. “According to some sources, 80% of the crypto workforce joined the industry in 2021, indicating that many individuals are exploring new opportunities in crypto.”

“More and more people are coming for exchange, especially this year”

Employee at One Satoshi Mong Kok ready for customer.

One Satoshi Mong Kok is located on the third floor of a business building next to Nathan Rd. This is one of the busiest roads in Kowloon, so it can be difficult to find the narrow entrance of the building even if you are a local.

Stepping out of the elevator, most shops were closed even though it was a Monday afternoon. One Satoshi was right next to the elevator with the neon light board on. In fact, the store was relatively small with only a counter and an open space that could accommodate two people max. It would be hard to distinguish the difference between it and any other currency exchange store at Sheung Wan or Tsim Sha Tsui except the screen displaying bitcoin currency instead of dollars or pounds.

“The rent here is cheap,” said Kalok. “And we have two major advantages compared to other platforms or cryptocurrency ATMs: One is our spread is very low so that people can get more money or more coins, the other is that we have a staff to answer all the questions.”

More people started to hold cryptocurrency or do leverage trading after everything going on about crypto in Hong Kong lately. Two men were queuing for a withdrawal, while another waited to deposit cash into his coin wallet. Each transaction took less than a minute, with no paperwork to be done. However, the rush still continued as Kalok answered the phone from a lady asking about the details of an exchange.

“We also have lower transaction fees, for small transactions that are lower than HK$5,000, it’s HK$25 for all. For a higher amount, you don’t have to pay anything.” he added. “Some customers told me if the bitcoin price goes up and down, then the ATM would take a high price.”

Pertaining to the government announcements, the Hong Kong government will review and revise the systems of cryptocurrency platforms in order to give out licenses for business starting from June. The regulations would benefit most of the industry, especially for cryptocurrency exchange platforms like One Satoshi. Currently, it already has six more branches in Causeway Bay, Kwun Tong, Kowloon Bay, Sheung Shui, Lai Chi Kok and Tsim Sha Tsui.

When asked if more people are coming in for coin exchange, Kalok answered: “Yes, more and more. Especially this year.” He said that local customers usually visit their shop, but they have seen an increase in foreigners and mainlanders this year.

Photos of One Satoshi Mong Kok.

Crypto is becoming part of the everyday

“What doesn’t kill me make me strong”

Solomon Chan was raised by his mother alone in a single parent family. After graduating from university, he decided to work for a securities agency for a reasonable salary even though his adulthood interest has always been in the music industry.

After six years in the securities agency and three years in personal banking, he decided to quit. Chan gave up this very profitable traditional finance business because he saw a potential in cryptocurrency, and not so many others have seen that at the time. However, this is not the story about a young man making big money on bitcoin trading while others are unaware, it’s about him helping others to discover it as well.

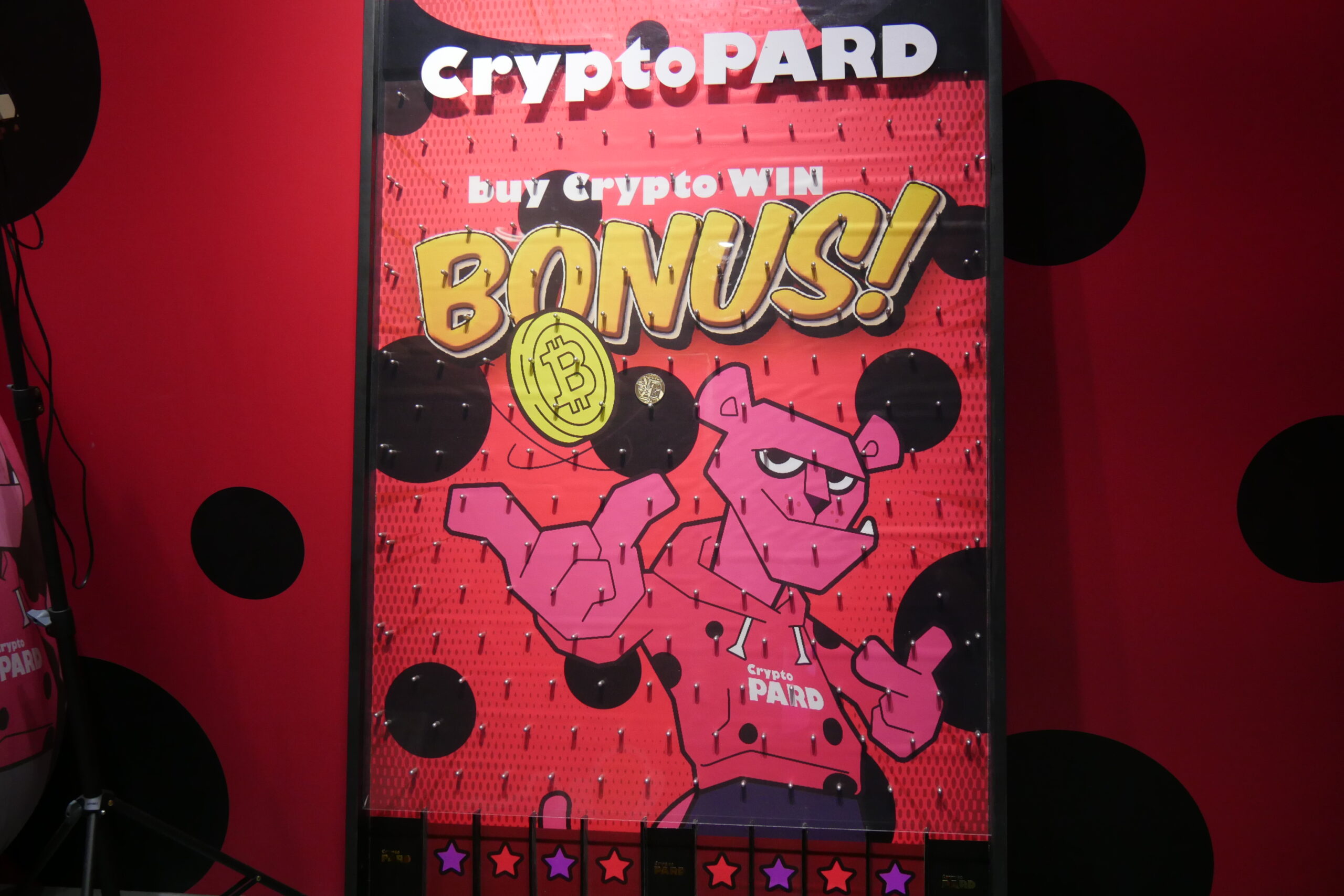

Pink animated leopard in a hoodie shines on the huge LED screens on the streets of Mong Kok and Tsim Sha Tsui.

“Many people heard about cryptocurrency investments a lot but had no idea how to start because of the lack of popularization,” said Chan. “My vocation is to make cryptocurrency investments achievable for the public, that’s the reason why I established CryptoPard.”

Being the only cryptocurrency institute in Hong Kong, CryptoPARD currently offers crypto investment lessons to beginners and amateurs in Mong Kok and Tsim Sha Tsui.

“The rent itself costs more than HK$ 1 million per month, and no one signed up for lessons after our first public free lecture. We invested in everything and we were losing so much money,” said Tommy Xia, co-founder of CryptoPARD. “Then one guy paid the deposit for lessons after our second lecture, although it’s only one guy, we felt successful immediately because we knew people started to notice us.”

After the Hong Kong government iterated their positive attitudes towards crypto, CryptoPARD’s business started booming.

“Our peak was around 30 people per lecture last year, but now it is almost full every week at about 60 people. We don’t have enough room and chairs in the TST branch now.” said Xia.

CryptoPARD location at Tsim Sha Tsui, Hong Kong.

CryptoPARD location at Mong Kok, Hong Kong.

“You could just copy the JPG, but you still choose to buy the NFT”

“Publish as you write, collect as you read.” The words that welcome you on the home page of the Liker.Land app. As you scroll, article clips from Web3.0 Project Hub magazine, a postcard from San Francisco written in traditional Chinese, and a photograph of the famous bookstore Guesthouse Susu in Taitung fill your page.

The diversity in content might mislead you to think that this app is a writing platform, but it is actually a Web3.0 marketplace for creators to publish their content as NFT or to use protocols to register their contents on blockchain. Creators can simply write on the platform they choose like WordPress or even on a document, and then they can share their work to the app marketplace.

The current business model of content is very broken with a lot of other limitations in terms of how creators can monetize and interact with their friends, so we see this opportunity in Web3.0 where elements like NFT could apply.” said Phoebe Poon, the founder of Liker.Land.

Poon with her team launched the project demo on September 25, 2020 when the NFT market was rising. However, the upcoming several collapses of the NFT market didn’t affect Liker.Land. Contents of Liker.Land only became more condensed over time.

“NFT today is basically a container to let you put data inside. So we imagined what NFT might be in our case, and we do think writing is a good feed,” said Poon. “This format could carry on values to our readers, yet there are no newer formats in Web3 so far.”

As Poon described, nowadays people can basically have access to all information online, and that’s where people mix access with ownership. Even if you can get a free copy of any book on Google, you still want to drop by a bookstore and get an original copy. Same as NFT, you can just copy the JPG, but you still choose to pay for the content.

“Ultimately, the writing NFT is a way for you to support the creator that you like,” said Poon.

Just like she said, this app is the paradise for wordsmiths with a curiosity or penchant for purchasing virtual assets collections, and for writers or photographers who seek recognition.

“You may say I’m a dreamer, but I’m not the only one.”

Curiosity pushes human society to evolve.

To the realism and optimism of DeFi in Hong Kong.

Extra Credits

Advisor Diana Jou

Editorial Director Hailey Yip

Multimedia Director Madeleine Mak

Multimedia Producer Wulfric Zhang

Copy Editor Karin Lyu

Fact Checker Claire Kang