The Great Crypto Crash Of 2022

By Wen Xudong

With the high salary he was earning from his job in the technology industry, Michael Chen and his wife were able to acquire a large loan for a new house. On top of that, Chen was making a lot of money from investments in cryptocurrencies. With the profit he gained, he put a down payment on a new car and could still invest more money into the crypto market.

He never expected that his investment in one of the most reliable cryptocurrencies, known as stablecoin, would backfire so spectacularly. In May of 2022, he lost around HK$550,000 in a week.

What happened to Chen is a microcosm of the crypto market in 2022?

Chen was forced to sell his car, for a very low price, just to maintain his daily expenses.

“I had to sell it. To be honest, my everyday life was affected. I couldn’t afford the monthly payment for the car and I needed money to pay my huge loan for my house,” he said.

A main characteristic of cryptocurrencies is that their prices usually see large fluctuation. This has made the crypto industry ripe for investment. ‘Stablecoins’ were introduced to provide a less volatile cryptocurrency for general online transactions.

Unlike other cryptocurrency, stablecoins are usually pegged to real currencies. Whilst the price of a single Bitcoin, arguably the most famous cryptocurrency, has ranged from HK$2340 to over HK$360,000 in the last ten years, the rate for one Tether token, the world’s first stablecoin, should constantly be around 1:1. $1 for one Tether token (otherwise known as USDT).

Tether achieves this by effectively having enough dollars and assets in its reserve to account for every USDT in circulation.

The stablecoin and cryptocurrency Chen had invested in, and had lost him so much money from, were named UST and LUNA.

The Story of Terra LUNA

The crash of Terra LUNA caused an earthquake throughout the crypto market, taking out currencies as well as NFTs. According to Crypto Slam, nearly all NFTs and cryptocurrencies suffered a huge price drop, and there has been a lasting emotional influence on the market, too.

LUNA is a native cryptocurrency to the payment platform Terra. Its role is to maintain the price of Terra’s stablecoin UST, by balancing supply and demand. LUNA ensures that the going rate for UST stays at 1:1. $1 for 1UST. This stabilisation is achieved using an algorithm and through its relationship with LUNA and UST.

It’s important to remember that one UST is supposed to be equal to $1, whilst the price of LUNA will fluctuate. The upper limit of LUNA coins that Terra issues is 1 billion.

The algorithm ensures that when one UST is bought, the amount of LUNA equal to $1 is ‘burnt’ in order to ‘mint’ that one UST. And the same happens when a transaction goes the other way, from UST to LUNA. But, because of that cap, when more LUNA becomes available, its value decreases.

Although UST is pegged to the US dollar. One UST is not always worth $1. Slight fluctuations in the price of UST give people the opportunity to gain profit.

When the price of one UST floats to 1.1 USD, if you use the amount of LUNA worth one USD to mint one UST, you would earn 0.1 USD. If UST’s price is lower than $1, investors will burn their UST to mint LUNA. The price of UST is basically maintained stable by using this relationship between supply and demand.

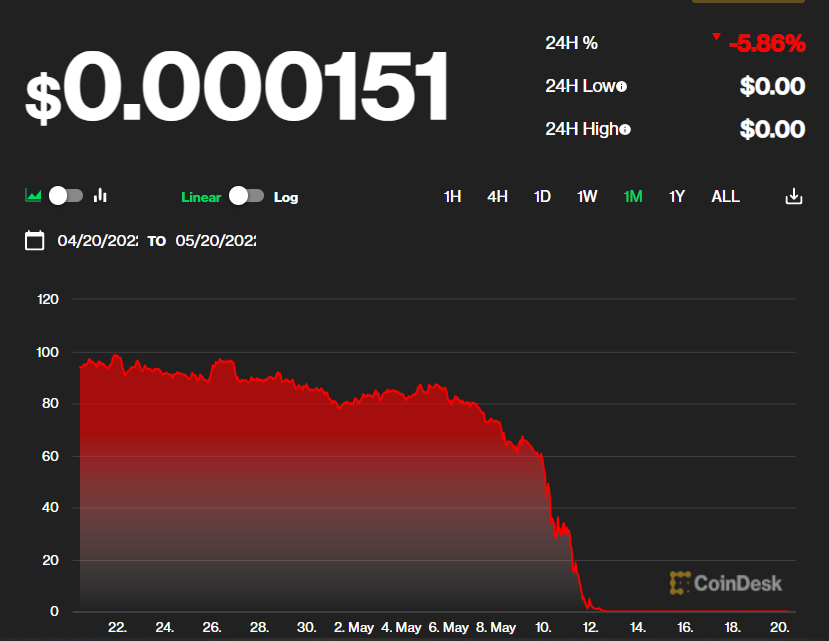

According to data from investing.com, on April 5, 2022, one LUNA coin was worth around HK$930. By midway through the next month, the price approached 0.

Luna price April 20, 2022 – May 20, 2022. (Source: boldergroup / screenshot from CoinDesk)

In June 2020, Terra launched a project called Anchor. Consider Anchor as a bank for UST. The annual interest for physical banks is around 3% a year, so if you deposit $100 for a year, you would get $3 as interest. But for Anchor, the interest rate is around 20%. If you deposit $100-worth of UST, you would get $20 as interest.

In order to take advantage of such high interest rates, people started buying higher volumes of LUNA to cast into UST and deposit into Anchor.

As more and more people bought LUNA, its price kept getting higher, rocketing UST to the third largest stablecoin in the world.

Unlike ordinary stablecoins, Terra does not have the asset reserves to cover the value of UST in circulation. Therefore, when investors abandon LUNA and UST at the same time, there are not enough reserves to help stabilise the price, causing the value of both to plummet.

As early as 2018, doubts over LUNA and UST were being raised, as well as what would prove to be successful predictions on what happened in 2022.

On May 7th 2022, $2 billion-worth of LUNA (HK$16 billion) came out of Anchor. Controversy remains over whether this was a malicious attack on Terra’s blockchain. The supply for UST suddenly had a huge increase, causing the price of UST to drop dramatically. The price of UST soon dropped to under $1. As a result, as mentioned before, people started to burn their UST to mint LUNA, increasing its supply and causing its price to drop.

According to data from investing.com, on May 12, LUNA continued to plummet by 99%, and the price of UST fell below $0.2.

When the death spiral began, Chen struggled to come to terms with what was happening. He could do nothing but watch his money burn.

“When I realised what was happening I lost my mind and wanted to withdraw the only money I had left, Binance [Binance is the most popular cryptocurrency exchange platform that allows people to trade cryptocurrency inside.] had suspended transactions and withdrawal of LUNA.”

In a week he had lost his profit of around HK$160,000, as well as the original amount he had invested.

The founder of TERRA LUNA Do Kwon was arrested in March 2023 in Montenegro. (Source: Savo Prelevic/Getty Images)

Terra’s founder, Do Kwon, faced fraud charges in both America and South Korea. He was arrested in Montenegro in March of 2023 and is reportedly set to be released on bail soon.

The crash of Terra LUNA set off a series of chain reactions.

In June and July of 2022, Three Arrows Capital, one of the largest hedge funds in the cryptocurrency market, and Celsius, the largest cryptocurrency lending platform in the United States, declared bankruptcy one after the other. Terra had been their main investment project.

The shockwaves also reached the world of NFTs.

Tremours in the NFT Industry

According to NFT industry data aggregator CryptoSlam, NFT global sales dropped from around US$4.5 billion (HK$35 billion) to under US$1 billion (HK$7.8 billion) in July 2022.

Below is a gallery of four NFTs, picked from the NFT trading platform OpenSea. Each comes from the all-time top 10 NFT collections according to ranking statistics from Opensea.io.

If you look at the shift in floor price (the lowest price for the cheapest NFT in a project) from 2022 to today, of these four projects, you would see a trend of floor prices going down and recently hitting bottom.

According to statistics from NFTPricefloor.com, the all-time highest floor price for a Bored Ape Yacht Club NFT reached around $370,000(HK$2,886,000), at 5 p.m. on April 30, 2022. Almost a year later, the floor price was under $100,000(HK$780,000).

As for Cryptopunks, the all-time highest floor price, according to NFTPricefloor.com, came to around $420,000(HK$3,276,000) at 5 p.m. on Nov 4, 2021. At 5 p.m. On May 1st, 2023, the floor price was also under $100,000 (HK$780,000).

Another famous example is an NFT of the first-ever Tweet, purchased for around HK$23 million in 2021. Two years later, it’s now only worth around HK$800. Money that could have bought a house is now worth only a dinner.

just setting up my twttr

— jack (@jack) March 21, 2006

An NFT of the first-ever Tweet created by Twitter co-founder Jack Dorsey, sold for $2.9million USD in 2021

You may say that these examples are detached from the experiences of ordinary people, that they are way too expensive for the average person to afford. So what has happened to NFT projects that the everday person could buy?

Shawn He is in his senior year at college. In 2021, he found himself interested in NFTs and gradually started to invest in the market.

“In 2021, I told my friend that my aim was to buy a Mercedes G63 (1,600,000HKD), if the crypto market remained so lucrative,” he said, “But I lost nearly all of my money, and just want to sell all of my NFTs. I used to own 13. Now I only have two.”

On the right side is Shawn’s NFT collections. Shawn He only has four NFT collections left. Two of them are purchased by himself and the other two “3D ALINFT” were gifts from his friend.

According to He, copyright issues meant he lost money on his ALINFT investment. He spent about HK$12,000 on several ALINFT NFTs. The floor price of this project is now approaching zero.

It is the same story for “Geisha Tea House”, with the floor price of this NFT project also approaching zero.

The best investment he made was buying “Acrocalypse” for around HK$6000. At its height, the price of his “Acrocalypse” NFT reached over HK$40,000. But he didn’t sell it and now that profit is gone.

However, the distributor of “Acrocalypse” is a Web 3 celebrity, meaning people have more faith in his project. The floor price for this project is still around 0.1 ETH, which is around HK$1400 when the article was written. For that reason, He still keeps one “Acrocalypse” NFT.

Although his investment has not paid off so far, He is still hopeful that the market will bounce back.

In July of 2022, with the crypto market crippled, it seems like the situation couldn’t get any worse.

FTX’s Bankruptcy

In 2020, FTX was the third largest platform in the world for buying and selling cryptocurrency, with over 1 million users and a $32 billion(around HK$256 billion) valuation. The FTX empire’s downfall, along with its sister company Alameda Research, took just 10 days in November 2022. Its bankruptcy was the second major disaster to shake the crypto market that year.

Sam Bankman-Fried founded FTX in Hong Kong in 2019, and soon issued its own cryptocurrency FTT to create revenue. In Hong Kong, FTX’s business grew rapidly. The company raised $900 million from investments and has since then become one of the largest cryptocurrency companies in the world. FTX and Bankman-Fried eventually left Hong Kong and moved to the Bahamas in September 2021.

Sam Bankman-Fried (SBF) in court for FTX case. (Source: Alex Wong/Getty Images)

On Nov. 2, 2022, leaked financial documents disclosed by CoinDesk showed that most of Alameda’s balance sheet assets were in FTT tokens, issued by FTX, a relationship that most FTX investors weren’t fully aware of. The liquidity of FTT is very poor. Combined with the fact that some researchers have found that FTX’s reserves are constantly draining. As a result, this raises doubts about the Alameda’s ability to pay their debts.

At first, the market did not pay much attention to rumours on Alameda’s debts because people considered the worst case scenario would be that Alameda went bankrupt. However, everything changed once Zhao Chang Peng, the founder of the largest crypto trading platform Binance, claimed he was going to sell all the FTT tokens owned by Binance.

After Zhao’s statement, the market began to panic. The price of FTT went down significantly as more and more people tried to get rid of their FTT tokens, selling at a crazily low price. At the same time, because of worries about the effect on FTX, more and more FTX users tried to withdraw their money from the platform.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

On Nov. 8, 2022, FTX froze user withdrawals, and announced that the company did not have enough capital reserves to process each user’s withdrawal request, FTX had been using customer funds to support its own trading activities.

Binance made a claim to acquire FTX, but ultimately decided against doing so having looked into the disastrous situation the company was in. By November 11, FTX had declared bankruptcy.

Bankman-Fried was arrested in the Bahamas in 2021 and later extradited to the U.S. He is set to face trial on eight criminal charges. Bankman-Fried was eventually released on a HK$2 billion bond secured against his parents’ property with restrictions on his movement.

With all this being said, an interesting phenomenon can be seen from the tweet on the left. The top NFT collections appear to be unaffected by the ongoing FTX-Binance situation. The reason for this could be that the price for crypto currency is declining, as a result, you can buy famous NFTs at a lower price since the ETH (the cryptocurrency ‘ethereum’) is cheaper than before. This has lowered the entry threshold for top NFT projects and stimulated the consumption of them, to a certain extent.

Instability in the Crypto Market

Bluntly said, the current situation of the crypto market can be described as dismal, when compared to the market’s peak. Aside from the downfall of LUNA and FTX, there could be several possible reasons for the market’s shift.

One could be the idea of ‘hot topics’. Even if you know nothing about AI, you will have most likely heard of ChatGPT. Like NFTs in 2021, AI is the viral sensation of the moment. The reality is that, in 2023, the attention on NFTs has significantly dropped. Interest is fading and the hot money has moved to ChatGPT and AI.

Another possible reason could be the suffering of the global economy, affected by a number of factors.

Li Shun is an NFT distributor based in Los Angeles. When asked what he thinks the main reasons are for the price drop in the crypto market in 2022, he raised some important points.

“The first thing I want to mention is the influence brought by the crash of those crypto trading platforms,” Li said. “People would consider the industry unstable if the top trading platform could crash so easily and rapidly, investors would lose confidence in this market.”

One of Li Shun’s NFTs (Source: Li Shun)

“Another reason is, in this market, the institutional investors are still the main characters, not ordinary people. Under the context of high interest rates, institutions would definitely withdraw their money from the crypto market and then in other fields.”

However, Li still feels positive about the future. He considers the current price fall as following a normal economic cycle.

April Wong is a Web 3 industry practitioner based in Hong Kong. She also shares the same point of view as Li. “From my perspective, it’s merely a reflection of the natural ebb and flow inherent in the crypto cycle. Traditionally, the crypto economy and conventional finance have operated on separate tracks. However, during the last supercycle, I noted a significant overlap between the two, particularly in their market cycles,” she said.

In reference to the crashes of LUNA and FTX, Wong said “we saw $5 billion and around $10 billion of market value disappear during the decline. This undoubtedly shook investor confidence, especially given the diverse range of crypto experience, from degen (seasoned crypto enthusiasts) to curious newcomers. If anything, these incidents reinforced the infamous reputation of cryptocurrency”.

And as both a crypto investor and a professional in the industry, Wong has also been influenced by the great crypto crash of last year. “The market decline has certainly affected me. On one hand, the value of my crypto holdings has substantially decreased. Fortunately, I made early investments when Bitcoin (BTC) was around 4-8k USD, so despite the drop, I’m still in a positive position, at least with BTC. On the other hand, my investment in Luna ended up being ‘rugged’,” she said.

What happened in 2022 once again reminded us that crypto currency and NFT markets are a world where opportunity and risk coexist. A failed investment could not only make you lose all your pocket money, but could also force you to sell your car to support your life, or something much worse to you.

Extra Credits

Advisor Diana Jou

Editorial Director Hailey Yip

Multimedia Director Madeleine Mak

Multimedia Producer Daoli Zhang

Illustrator Simeng Xu

Copy Editor Jamie Clarke

Fact Checker Larissa Gao