By Coy Li Xukui

HKU Journalism and Media Studies Centre

In China, the expensive medical treatment for pets has become a bothersome problem for pet owners. (Source: VCG)

“Still foolishly paying high medical bills when your pet gets sick? For only 0.55 yuan per day, it will save you a ton of money.”

“Don’t wait until your pets get sick. You can buy it for less than a meal.”

“It just takes one minute; you will save money for your pets’ visits to vets.”

On Douyin (China’s TikTok), advertisements for pet health insurance with seductive slogans are targeted by big data and delivered to pet owners.

As the second largest market in the world for pets and pet products, China’s pet economy is huge and still growing rapidly.

According to “The Pet Industry Blue Book: 2023 China Pet Industry Development Report” released by Euromonitor International, the number of pets in China is close to 200 million, second only to the United States. China’s pet market has reached nearly 250 billion yuan (US$33.7 billion), one of the fastest growing in the world.

Pet healthcare is set to be the fastest growing category in pet products, a Euromonitor April 2024 China report also found.

But behind the targeted advertisements and slick slogans, China’s evolving pet health insurance industry can be hard to navigate for the country’s pet owners. And according to some of them, it is rife with unclear policies and unprofessional practices that leave customers wondering what was the point of buying pet health insurance.

Small investment against costly illness

How to save money during pets’ visits to doctors? This is a question that affects all pet owners. Data released by ZhongAn Insurance show that, in China, the average cost of each vet visit is 2,390 yuan for cats and 2,786 yuan for dogs.

On Little Red Book (XiaoHongShu), a Chinese social media platform, countless pet owners shared long bills they got after visiting the vets, with captions such as: “It’s more expensive to treat a pet than a person!”

On XiaoHongShu, pet owners shared receipts showing they spent thousands of yuan on veterinary care for their pets.

Driven by this situation, health insurance coverage is no longer limited to people, but has also penetrated the pet industry. A survey of China’s health insurance industry found over 20 companies now offer pet health insurance, mainly for dogs and cats.

Currently, mainstream pet insurance is categorized into pet health insurance, pet liability insurance and other pet insurance such as pet transport insurance. Among them, pet health insurance refers to the reimbursement of expenses incurred for medical treatment of pets suffering from accidental injuries or illnesses.

Annual insurance premiums and annual insurance costs, which pet owners are most concerned about, vary from product to product. Taking the products of ZhongAn pet health insurance as an example, the policies can be divided into three levels. The annual insurance premiums are 198.96 yuan, 419.04 yuan, and 769.08 yuan; the corresponding annual insurance amounts are 10,000 yuan, 15,000 yuan, and 30,000 yuan.

Coverage can also be purchased for many complimentary services such as deworming, vaccinations and bathing. The higher the policy cost, the more complimentary services are covered.

Such attractive services have tempted many pet owners to sign up.

The cost of protection

Feng Shirui, the owner of a Staffordshire bull terrier and three Maine Coon cats, from Guizhou Province, is one of them. Her pets are like her children, she said. She even maintains a home webcam to monitor them when she’s at work.

Feng treats her pets as her children and posts pictures and comments on XiaoHongShu based on her dog’s perspective. Photo courtesy of Feng Shirui.

Feng learned about pet health insurance through an advertisement for Ant Insurance on Douyin. Ant Insurance is part of the Ant Group, an affiliate to the Alibaba Group. Due to the backing of a large conglomerate, Feng said she thought the company was “more reliable”, with a relatively simple claim settlement process, “directly uploading cases and other supporting documents.”

She purchased pet health insurance for 33.25 yuan per month with an annual coverage of 15,000 yuan for each of her four pets.

At the end of 2023, her dog accidentally ingested cotton, causing an intestinal blockage, and then needed stitches after being cut by glass. Feng claimed for both accidents and was reimbursed for nearly 1,000 yuan.

Feng believed pet health insurance was a very good protection for her pets.

“This is why I think pet health insurance is not a scam,” she said.

Hidden claim denials

However, not every consumer has had such a positive experience with their pet health insurance.

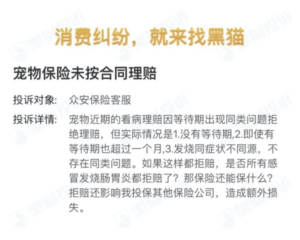

A search of keywords “pet health insurance” in Black Cat Complaints, Sina’s consumer service platform, revealed a total of 710 complaints, most of which are focused on the claims process. A common response was “customer service shirking responsibility and refusing to reimburse.”

Liu Bo, the owner of a poodle, purchased pet insurance on Alipay for her dog starting in November 2023.

She, like many interviewees, said she was worried about speaking out. Liu Bo is not her real name.

In February this year, Liu’s dog suffered from an ear infection, and she spent several hundred dollars on treatment. When she applied for reimbursement, the insurance company rejected Liu’s application with the reason of: “Your pet was diagnosed with a metacarpal fracture within one year prior to insurance, which does not meet the pre-insure health notification.”

The insurance company listed Article 11 of the insurance policy terms, which states: “the insurance company shall not be liable for the health/behavior of the insured’s pet if it is found not eligible to be purchased. In the event of an insured accident, the insurance company is not liable for compensation.”

Liu said it was very unreasonable. “If my dog doesn’t qualify for a claim, why didn’t the insurance company just deny my coverage?” she said. “Instead, I was only informed when I needed its claim.”

The same thing happened to Shanghai-based Hu Ling, the owner of a 2-year-old border collie.

Last November, she applied to ZhongAn Insurance to pay for her dog’s expenses of 10,000 yuan for treatment of a fever, but she was rejected. The reason was Article 6 of the Exclusion Clause, which states “pets with injuries, diseases or symptoms that already existed before the effective date or during the waiting period of the insurance contract, are difficult to get claims.”

Hu said her dog had been suffering from fevers before being insured. She could understand if the insurance company had refused to insure her dog from the beginning. But after she had already paid the insurance for several months, the insurance company denied her claim.

“And it was not proven that the fevers were caused by the same reason,” she said.

Unsatisfied with the insurance company’s response, Hu posted a complaint on Black Cat Complaints.

Hu Ling posted a complaint on Black Cat Complaints saying: “The insurance company failed to pay a claim according to the contract.”

A few days later, the insurance company gave Hu 400 yuan for compensation and refunded two months of premiums.

But Hu said she was not satisfied, for she felt that this compensation was far less than what she would have received under the normal payout process.

Hu added on Black Cat Complaints: “No agreement was reached, and no follow-up was provided.”

When contacted by HKU Journalism for comment about such complaints, ZhongAn customer service reiterated its policy on treating ongoing conditions and diseases and said that claim compensations are “subject to the examination of the uploaded materials and the claims adjuster.”

Few types of claimable pet medications

Currently, pet medications that can be claimed are mostly anti-inflammatory drugs, while imported medicine, health care products, special food, etc., are excluded. Coverage of medication is limited.

Zhang Chi is the owner of a 13-year-old border collie. When her dog was 9 years old, she purchased ZhongAn’s pet health insurance for 16.58 yuan per month.

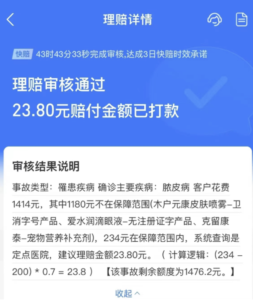

Earlier this year, her dog was diagnosed with a tumor, pre-cataracts and pyoderma. Zhang took her dog to a local vet hospital, where the doctor prescribed medication costing 1,414 yuan.

During the visit, Zhang had repeatedly told the vet that she needed to be reimbursed, according to her insurance policy. However, the vet said he didn’t know if those medications would be covered.

When Zhang made a claim, the insurance company said medicines valued over 1,180 yuan were not covered, such as eye drops and pet nutritional supplements. The actual amount that could be reimbursed was only 234 yuan.

In addition, most pet health insurances have yearly deductibles, which the insurance companies deduct and then pay out at the benefit rates. The deductible for the ZhongAn pet health insurance is 200 yuan. After deducting the deductible, Zhang received only 23.80 yuan for her claim.

Within two days after applying for a claim to her pet insurance company, Zhang Chi received the payout of only 23.80 yuan.

Zhang said, as a consumer, she did not know whether the drugs were reimbursable or not, and she could only purchase the drugs at a designated hospital following the vet’s prescription.

“Medical exams are not covered; most medications are not covered. So, what’s the use of this insurance?” said Zhang.

Vets have also struggled with the limits of pet insurance. Wang Ying, a vet in Zhejiang Province, was careful with her comments, saying the pet industry is small in China and any complaints might affect her career. However, she did say that one problem is that “pet medications are inherently scarce.”

Wang explained that medical product numbers of pet medicines are difficult to get approved in China. So, most of the pet medicines are listed under the “feed” product numbers, and the external medicines are listed under the “disinfection” product number.

“It is unlikely that vet hospitals refuse to prescribe medications to pet owners just because the medications are not reimbursable,” said Wang.

Customer service at ZhongAn Insurance told HKU Journalism that there is no list of reimbursable pet medications right now. After customers submit related materials, auditors will judge whether the claim can be settled, with reference to the scope of non-reimbursable medicines in the Exclusion Clause.

Higher prices in designated hospitals

Notably, insurance companies usually provide a list of pet hospitals as designated hospitals that clients must use. The percentage of reimbursements is larger when customers go to designated hospitals for treatment.

For example, ZhongAn pet health insurance stipulates that the compensation ratio is 60% for visits to designated hospitals and 40% for non-designated hospitals. Another insurance company, Ping An, stipulates that the compensation ratio is 70% for treatment in designated hospitals; no compensation will be paid for non-designated hospitals.

However, in China, due to the lack of uniform pricing standards for diagnosis, treatment and medicines, some designated hospitals have been accused of over-examining and over-pricing medications to insured pets.

Zhang said that to treat her dog’s tumor and other conditions, she took it to two local designated hospitals.

In the first designated hospital, the doctor prescribed a series of checkups for the dog, including X-rays and blood tests. However, nothing useful was found. The vet told her that she could observe the dog for a while, and prescribed many boxes of chondroitin for her dog, as well as prescription dog food for weight loss.

Feeling that this hospital was unreliable, Zhang found a well-known vet on XiaoHongShu at another designated hospital.

At the time of booking, the vet hospital indicated that it was necessary to charge a “naming fee”, which could be interpreted as “the vet was very busy, so extra money was needed if I wanted to see him,” Zhang said. This naming fee was included in the registration fee and wound treatment fee, and was not a separate fee.

Eager to treat her pet, Zhang accepted the naming fee. She said: “I can accept all these expenses to get my dog to regain its health.”

Liu Jun, a kennel owner in Chengdu, also said some of his clients have been charged arbitrary fees in designated hospitals. “Pet health insurance may cost pet owners more money,” he said, adding that it’s a reason why he doesn’t recommend pet health insurance to his clients.

ZhongAn customer service responded that: “the designated hospitals are only our division of hospital qualification, not necessarily a cooperative relationship with our company.”

The department representative said the insurance company could not intervene in the hospital’s charges because charges were not part of the insurance policy. Different charges of designated hospitals have no effect on clients’ reimbursement, according to the company representative.

Expanding market awaiting regulation

At present, China’s pet health insurance industry is still in the development stage. According to The 2023 Pet Insurance Industry White Paper released by ZhongAn Insurance, the penetration rate of pet health insurance in China is still less than 1%. Compared with places like France (5%), Japan (15%) and the U.K. (27%), there is still room for growth.

Huang Liqiang, deputy director of the Insurance Research Center of Liaoning University, is an expert with the Insurance Society of China. He said that the low penetration rate in China is because the target audience for the promotion of pet health insurance is mainly young people. This has led to a lack of awareness among middle-aged and elderly pet owners, resulting in the loss of some potential customers.

In addition, Huang explained, the singular sales channel is also a problem. China’s pet health insurance is mainly based on online sales channels, which need to be purchased on the official websites of insurance companies or e-payment platforms such as Alipay. However, in countries with high pet insurance penetration rates, the insurance products are usually sold based on scenario-based selling. Pet owners can add the insurance at pet supply stores or pet hospitals, for example, bundling it with pet-related services or goods such as medical care, boarding, and food, said Huang.

Sweden is the world leader for pet insurance, with an 80% uptake. The country is also where pet insurance began, first for livestock in 1890 and then for a pet dog in 1924. A century on from that first insured pet, a market research report from Grand View Research, released in March, stated that the global pet insurance market is expected to reach over US$33 billion by 2030, with a compound annual growth rate of 16.73% over the next six years.

In contrast to other countries, China’s pet health insurance industry started late. In 2004, Huatai Insurance launched Pet Liability Insurance, focusing on covering accidental injuries to humans caused by pets, which became the beginning of China’s pet insurance industry. After 2010, with the expansion of China’s pet economy, more insurance companies launched pet health insurance products.

Despite the late start, the market size is growing year by year. Data from Huajing Industry Research Institute shows that China’s pet insurance market size rose from 110 million yuan in 2016 to 6.3 billion yuan in 2022, with a compound annual growth rate of 96.33% from 2016-2022.

With such rapid growth, consumer protection is becoming increasingly important. Many interviewees expressed the hope of more effective regulation of the pet health insurance market by relevant authorities.

An industry report released in January 2024 by elabR, a data analytic firm, showed that China’s young generation has increased emotional commitments to pets, which makes them willing to provide their pets with comprehensive health coverage and high-quality medical care.

Echoing the sentiment of the pet owners interviewed for this article, elabR’s report recommended regulating the pet insurance industry “to help society build a welcoming and harmonious environment.”

Unfortunately for China’s pet owners, Huang said, it is currently unclear which organization is responsible for introducing an industry standard for the pet health industry.

But he is optimistic about the pet health insurance industry. In his opinion, the pain is inevitable, something that all industries go through when starting out.

“As the pet economy grows, this industry will become more and more regulated,” he said.

(At the requests of the interviewees who wanted to protect their privacy to avoid any problems with the insurance companies, Zhang Chi, Liu Bo, Hu Ling and Wang Ying are pseudonyms.)

Advisor: Jennifer Deayton