By Alice Li

HKU Journalism and Media Studies Centre

Hong Kong – As the owner of a restaurant chain in mainland China, Huang Haiying always wanted to expand her business overseas. She went on business trips to the U.S., Australia, Singapore, and Malaysia. Eventually, she picked Hong Kong.

In November 2022, the government of Hong Kong announced a new talent admission scheme to attract high-income professionals and graduates from top-level universities. Huang, whose restaurant has more than 50 locations in China, quickly decided to expand her business to the city. She filed her application for the visa after the Chinese New Year break. About seven months later, she landed in the city.

This is Huang’s first foray to the Hong Kong business world, but she finds it a welcome change from her previous experience. In mainland China, personal relationships were a prerequisite for business success. For example, if one needs to apply for a business license, it would be smoother with the right references. Compared to the mainland, Huang finds the business environment in Hong Kong more orderly and transparent.

“Everybody is equal, you just follow the rules. The sense of order brought me inner peace,” Huang said.

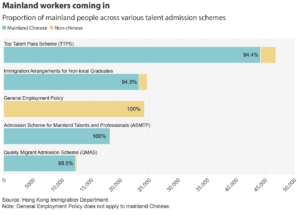

Huang is one of the more than 50,000 people who moved to the city from overseas with the new talent visa since its inception. After an exodus of professionals during the pandemic, the Hong Kong government introduced the Top Talent Pass Scheme, known as TTPS for short, at the end of 2022 to refill the ranks of the city’s skilled workforce. A two year-working visa will be issued to individuals with at least HK$ 2.5 million annual income, or a degree from top ranked universities. Eligible applicants don’t need a local employment offer upon application. Despite the initial intention to attract talents from around the globe, about 95% of the successful applicants of TTPS were from mainland China as of November 2023.

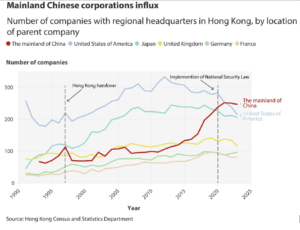

The influx of mainland Chinese is changing the fabric of Hong Kong as businesses are following in the footsteps of the people, moving headquarters, and opening branches of restaurants and stores in lockstep. The number of mainland Chinese corporations has been increasing, and China replaced the U.S. to become the biggest source of companies with regional headquarters in Hong Kong in 2023.

New tenants in town

Growing up in Hunan, an inland province in the middle reaches of the Yangtze River, Huang stayed in Guangdong after graduation. There, she started her business, which is a restaurant named “Hui Jia Xiang”. Just as the name implies, her restaurant serves Xiang or Hunanese food, one of eight major Chinese cuisines that originated in Huang’s hometown.

Before Huang’s Xiang restaurant entered the Hong Kong market, its location used to be an Egyptian restaurant called Aziza. In 2023, however, Aziza decided to shut down due to rising rent exacerbated by the effects of the COVID-19 pandemic on sales and foot traffic, according to a restaurant manager.

Mainland food and beverage brands have actively expanded their footprints in the city since the border between Hong Kong and the mainland was reopened in February 2023. A report from local property brokerage Midland IC&I shows that food and beverage businesses, especially mainland Chinese ones, are becoming the major tenants in the city’s four core shopping areas – Central, Tsim Sha Tsui, Causeway Bay, and Mong Kok.

“After the travel restrictions between Hong Kong and the mainland were lifted, we’ve seen a more active move to expand business in the city from Chinese food and beverage operators,” said Andy Kong, strategic director at Midland IC&I.

Some companies had planned to enter the Hong Kong market even during the pandemic, Kong pointed out, which explains the influx of mainland eateries to the city after Covid restrictions were lifted.

What’s more, Chinese catering brands are becoming more well-known among Hongkongers, as people flocked to the mainland to spend weekends and holidays after the border was reopened. As a result, mainland food providers have stronger confidence in expanding business across the border.

Two foreign restaurants in Sai Ying Pun, serving Italian and Egyptian food, have been replaced by Chinese eateries.

Two foreign restaurants in Sai Ying Pun, serving Italian and Egyptian food, have been replaced by Chinese eateries. Photo by Alice Li

Bringing mainland practices to Hong Kong

Mainland restaurant owners aren’t the only group that want to explore business opportunities in the city. Large Chinese corporations also show ambition to grab a bigger share of the Hong Kong market.

For instance, Hong Kong’s food delivery market used to be dominated by three foreign companies: Uber Eats, Foodpanda, and Deliveroo. But in November 2021, Uber Eats announced it would quit the market after five years of operation in the city.

“Uber Eats has unfortunately not grown as expected in Hong Kong,” the company said in an interview with South China Morning Post on November 30, 2021. “This decision has been made independent of the global pandemic, and is in line with our broader strategy on Uber Eats.”

Two years later, a new challenger came. Meituan, the on-demand shopping company in mainland China, launched its KeeTa food delivery service in Hong Kong in May 2023. For the first time, Meituan offered food delivery services outside of mainland China. In a press release, the company said the move was based on their observation that Hong Kong is a growing and unsaturated market in terms of food delivery service.

To outcompete Foodpanda and Deliveroo, the two entrenched incumbents in Hong Kong respectively owned by German and British companies, KeeTa brought business practices from its mainland version. It duplicates functions including the exclusive “on-time promise”. Users receive cash coupons with no threshold for future purchases if their order is delayed for more than 15 minutes beyond the original delivery estimate.

The scheme gave KeeTa a leg up on its competitors. In the first quarter of 2024, KeeTa seized 43% of total food delivery orders, according to data from local analytics firm Measurable AI. Foodpanda and Deliveroo, which entered the market years earlier, accounted for 37% and 20%, respectively.

The “positive results” in Hong Kong have prompted Meituan to explore expanding into other overseas markets, Chief Executive Wang Xing said during the company’s latest earnings call.

Mainland influx

Similar to Meituan, many other mainland companies are eyeing Hong Kong as international companies retreat. The shift is transforming Hong Kong’s business community, thanks in part to incentive programs that are accelerating the change.

In December 2022, the government established the Office for Attracting Strategic Enterprises, or OASES, to lure investment from around the globe to Hong Kong. Among the 45 companies signed up with OASES to set up business in the city thus far, 35 are from mainland China, according to the government.

OASES was established in 2022 to attract pioneers in industries that are of “strategic importance”, including biotechnology, artificial intelligence, and financial technology. The office is dedicated to reaching out to target companies and carrying out negotiations. Once they sign deals to set up or facilitate business in Hong Kong, the office offers assistance in areas such as taxation, land acquisition, and visa applications.

As addressed by government officials in a signing ceremony, some of these enterprises will settle in Hong Kong shortly, while some already have footprints in the city and will expand them with assistance from OASES. Apart from Meituan, Chinese telecom giant Huawei and computer maker Lenovo have also reached partnerships with the Hong Kong government. Both Huawei and Lenovo have said they plan to provide AI services and invest in AI ventures.

However, international companies are largely retreating from the city. U.S. companies had the most regional headquarters in Hong Kong as of 1991, but the number has been declining since 2020 and reached its lowest in more than two decades in 2023. Companies from Japan and the UK, which were two other major players in the foreign-firm landscape in Hong Kong, are also moving out, government statistics show.

“Some of the companies are moving out to diversify the risk as China is no longer the best cost-effective solution given the trans-Pacific tension over the years,” said a spokesperson of the American Chamber of Commerce in Hong Kong, or AmCham, referring to U.S.-China trade and other disputes. Some other factors, for example the implementation of National Security Law and rigid Covid restrictions, have also “severely impacted” overseas perceptions of Hong Kong, said the AmCham spokesperson, who requested anonymity.

Enacted in 2020 after the 2019 anti-government protest, the National Security Law has prompted international concerns about freedom and human rights in Hong Kong due to its wide scope and vagueness. And the city’s strict Covid-19 policies lasted almost three years, forcing inbound travelers to quarantine in hotels for up to 21 days and canceling flights to Hong Kong on a moment’s notice. Thousands fled, resulting in an exodus of workers overseas.

But Hong Kong still has advantages such as low taxation, a common law system, and high-quality healthcare, according to AmCham. “When we look into the shoes of the mainland companies, the reason why they want to set foot in Hong Kong is because they see Hong Kong as an international city and they want to internationalize themselves,” said AmCham.

Hong Kong has seen a drop in foreign companies’ regional headquarters based here, but has experienced an influx of mainland Chinese firms and workers.

Hong Kong has seen a drop in foreign companies’ regional headquarters based here, but has experienced an influx of mainland Chinese firms and workers.

Still a better choice

Mainland workers are following companies’ footsteps to Hong Kong, attracted by the city’s higher wages and other perks. And visa programs such as the TTPS are accelerating the migration, making Hong Kong a top destination for mainland Chinese looking to move abroad.

Together with other six talent admission schemes that have been operating for years, the Hong Kong government issued more than 120,000 visas to all kinds of talents last year. Of these, 77% went to mainland Chinese applicants, government data shows.

“The salary level in Hong Kong is higher than that in the mainland. A lot of the applicants also wanted to let their kids attend schools in Hong Kong, which is another major factor that motivates many mainland residents to apply for the TTPS,” said David Hui, managing director of Centaline Immigration Consultants Limited, a local agency that offers services for people who want to apply for permanent residency in Hong Kong.

Huang’s new Hunanese restaurant in Hong Kong has already been open for business for two months. She said she likes the sense of order and kindness of people here.

Before moving to Hong Kong, she was based in Zhuhai, a city bordering Macau. Due to a sluggish economy, the catering industry suffered, leading to cutthroat competition. Huang described a constant price war among restaurants. For instance, if she offered a 30% discount, a rival would launch a 40% sale to attract customers. In contrast, restaurant owners in Hong Kong seem to focus only on their own business. Although there are several competitors who also serve Hunanese cuisine near Huang’s restaurant, none of them ever showed intention to price her out of business, she said.

As the mother of three boys, Huang brought all of her children with her when she moved to Hong Kong last year. As soon as the application was approved, Huang’s second son started to prepare for the Diploma of Secondary Education Examination, the university entrance exam in Hong Kong. She opened the first branch near the University of Hong Kong as this is the only school her son wanted to be admitted to.

Huang said she hopes to stay in the city for seven years, the minimum needed to claim permanent residency in Hong Kong. Despite the convenient life with low costs back in Zhuhai, she said she hopes her children will receive a better education in Hong Kong, which she believes will benefit their future career prospects.

“I want to inspire my son. I told him that I opened the store near HKU for you, so you should work harder,” said Huang.

Advisor: Cezary Podkul